The staffing industry, long a powerhouse in connecting talent with opportunities, is experiencing a new wave of excitement – a surge in Initial Public Offerings (IPOs). This article delves into the world of staffing company IPOs, exploring what they mean for the industry, HR professionals, and potential investors.

IPO 101: Understanding the Public Debut

An IPO, or Initial Public Offering, marks the first time a private company sells its shares to the public on a stock exchange. This raises capital for the company’s growth and allows investors to share in its potential success. Companies seeking an IPO must meet stringent financial and regulatory requirements, ensuring transparency and investor protection.

Top Reasons why Staffing agencies might choose Going Public:

- Raise Capital: This is the main driver for most companies going public. By selling shares, staffing companies can access large amounts of capital to fuel growth, expand into new markets, acquire other companies, or invest in technology and infrastructure. This can be crucial for competing in a dynamic industry like staffing.

- Increased Visibility and Credibility: Being publicly traded can enhance a company’s brand image and reputation, attracting top talent and clients who see the company as stable and transparent. This can also improve access to new partnerships and business opportunities.

- Liquidity for Investors and Owners: An IPO creates an exit strategy for early investors and founders, allowing them to cash out on their investments. It also provides liquidity for existing shareholders, making their investments more valuable.

- Employee Motivation and Retention: Offering stock options to employees can align their interests with the company’s success, potentially boosting motivation and retention.

Sustainability in the Long Run:

While going public has benefits, staffing companies must use the raised capital wisely and responsibly to sustain their business in the long run. Here are some key factors:

- Strategic Investments: The raised capital should be used for strategic investments that drive growth and profitability, such as talent acquisition, technology development, and expansion into new markets.

- Maintaining a Strong Financial Position: It’s important to manage finances responsibly, maintaining healthy profit margins and a strong balance sheet. This ensures the company can weather economic downturns and continue investing in its future.

- Focusing on Core Business: While diversification can be beneficial, companies should avoid straying too far from their core staffing expertise. Maintaining a clear focus ensures they remain competitive and relevant in their chosen markets.

- Adapting to Change: The staffing industry is constantly evolving, so companies need to be adaptable and responsive to changing market trends, technological advancements, and regulatory requirements.

IPO Governing Bodies for Staffing Companies

Several governing bodies play a role when a staffing company considers an IPO, with each having its own specific area of focus:

Securities and Exchange Commission (SEC): The primary governing body in the US is the SEC. They are responsible for enforcing federal securities laws and ensuring transparency and investor protection. Staffing companies going public in the US must register with the SEC and file detailed financial statements and disclosures.

Financial Industry Regulatory Authority (FINRA): FINRA acts as a self-regulatory organization for securities firms and oversees brokers and dealers involved in IPOs. They ensure fair and orderly execution of trades and compliance with relevant regulations.

National Association of Securities Dealers Automated Quotations (NASDAQ) or New York Stock Exchange (NYSE): These are the two primary stock exchanges in the US where staffing companies can list their shares. Each exchange has its own listing requirements that companies must meet.

State and Local Regulatory Bodies: In addition to federal regulations, staffing companies may also need to comply with state and local laws and regulations related to securities offerings and employment practices.

Independent Auditors: Before an IPO, staffing companies must engage independent auditors to review their financial statements and ensure they comply with accounting standards. This is crucial for providing accurate and reliable information to investors.

Legal Counsel: Experienced legal counsel is essential to guide staffing companies through the complex legal and regulatory aspects of an IPO. This includes drafting disclosure documents, filing applications with the SEC, and navigating various legal compliance requirements.

Investment Bankers: Investment banks play a key role in structuring and marketing the IPO, finding potential investors, and managing the overall offering process. Their expertise can be invaluable in ensuring a successful public offering.

Independent Underwriters: Underwriters are responsible for purchasing the new shares from the company and then selling them to investors. They assess the company’s risks and opportunities and determine the offering price.

Board of Directors: Ultimately, the decision to go public and navigate the IPO process rests with the company’s board of directors. They must carefully consider the potential benefits and risks, ensure compliance with all regulations, and act in the best interests of the company and its shareholders.

Staffing Pioneers: The First Public Recruiters

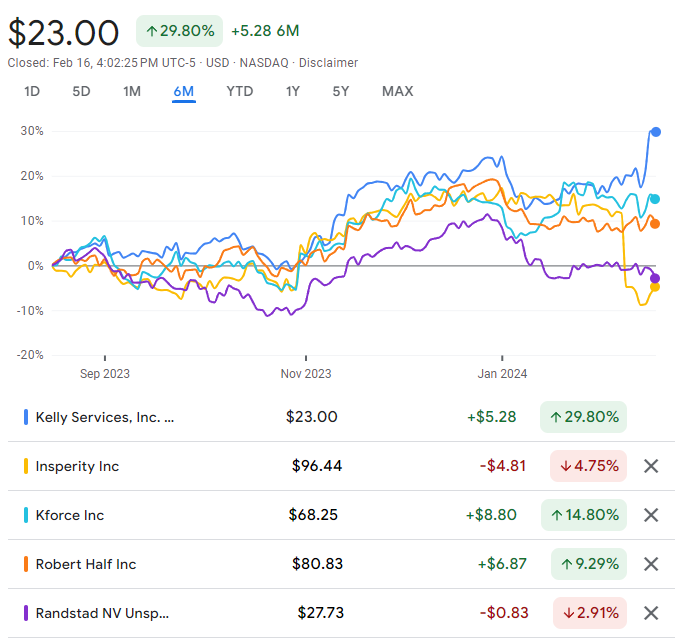

The history of staffing company IPOs boasts early trailblazers like Kelly Services, which went public in 1962, paving the way for others. Since then, industry giants like Robert Half International and Randstad have established themselves as publicly traded powerhouses.

Present and Future: A Hot Market for Staffing IPOs

The current market landscape is ripe for staffing company IPOs. Factors like the “Great Resignation,” digitalization, and the growing gig economy are driving demand for flexible staffing solutions. This confluence of factors has fueled investor interest, making IPOs an attractive option for many staffing companies.

Recent and Upcoming Staffing IPOs:

- FirstMeridian Business Services (India): Received approval in 2023 to raise ~$100 million.

- CIEL HR Services (India): Plans to IPO in Q2 of FY24, targeting ~$45 million.

- Personable (US): A tech-enabled staffing platform, filed for IPO in 2023, details under wraps.

What’s in it for HR Professionals?

The rise of staffing company IPOs holds potential benefits for HR professionals:

- Increased Industry Stability: Public companies operate under stricter regulations and scrutiny, potentially leading to greater stability and transparency within the industry.

- Career Growth Opportunities: Public companies often see rapid growth, creating more career advancement opportunities for HR professionals within these organizations.

- Stock Investment Potential: Successful IPOs can offer investment opportunities for HR professionals, allowing them to share in the company’s financial success.

For Potential Investors:

Staffing companies offer diversified exposure to various industries and economic conditions. However, thorough due diligence is crucial before investing, considering factors like market competition, technological adoption, and regulatory compliance.

The Bottom Line:

The increasing number of staffing company IPOs reflects a vibrant and growing industry. For HR professionals and investors alike, understanding this trend holds valuable insights into career prospects and investment opportunities. As the staffing landscape evolves, one thing remains constant: the need for skilled talent and the companies connecting them.